By: Admin July 09, 2024 Categories: GST Recent News The Centre will refund the compensation cess imposed on imported goods under the Goods and Services Tax (#GST) to businesses operating…

By: Admin July 09, 2024 Categories: GST Recent News The Centre will refund the compensation cess imposed on imported goods under the Goods and Services Tax (#GST) to businesses operating…

By: AdminJune 28, 2024Categories: CBIC|Notification And Circular>Customs4 Min Read The CBIC vide Notification No. 26/2024-Customs dated June 28, 2024 extends the exemption provide to imports of specified defence equipment’s for…

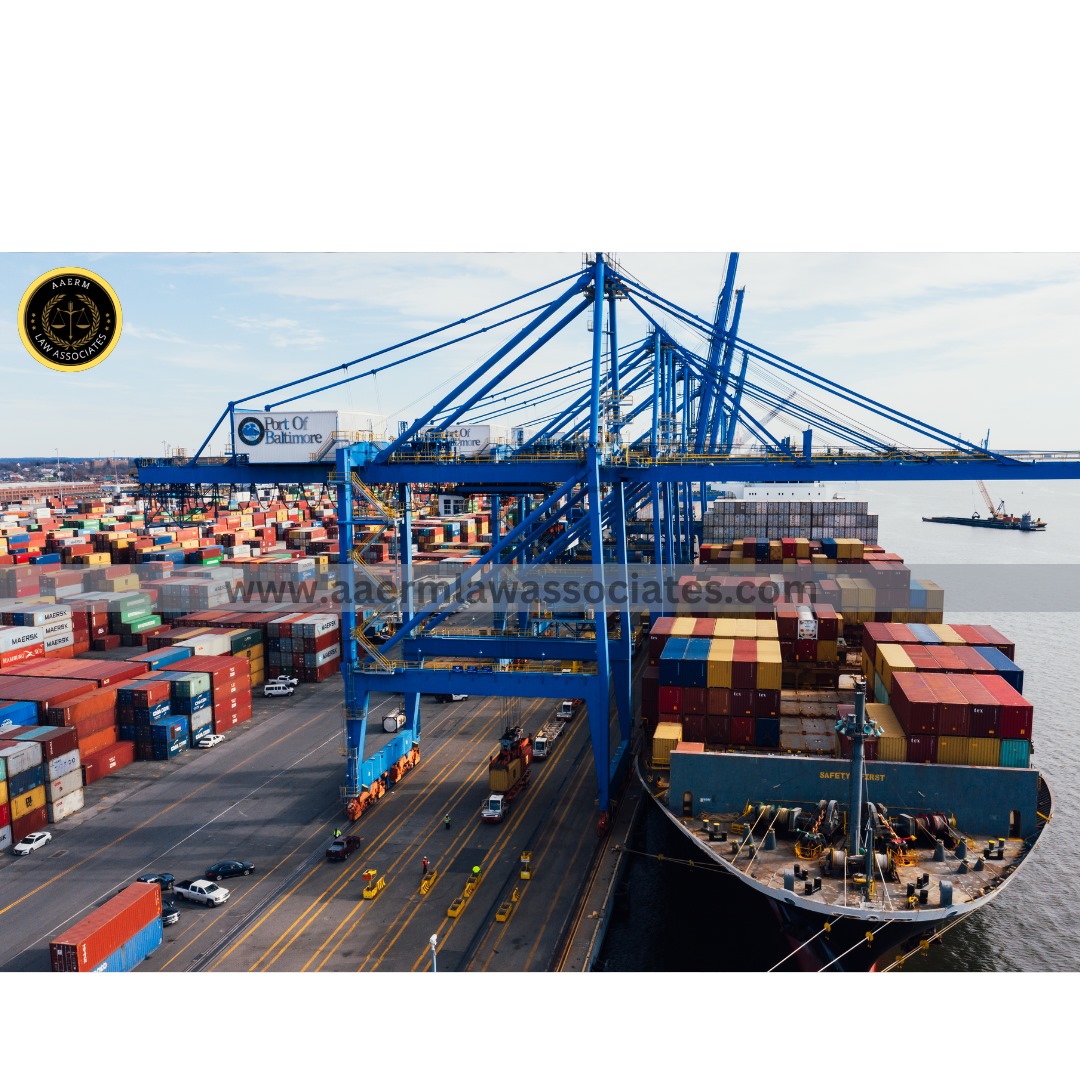

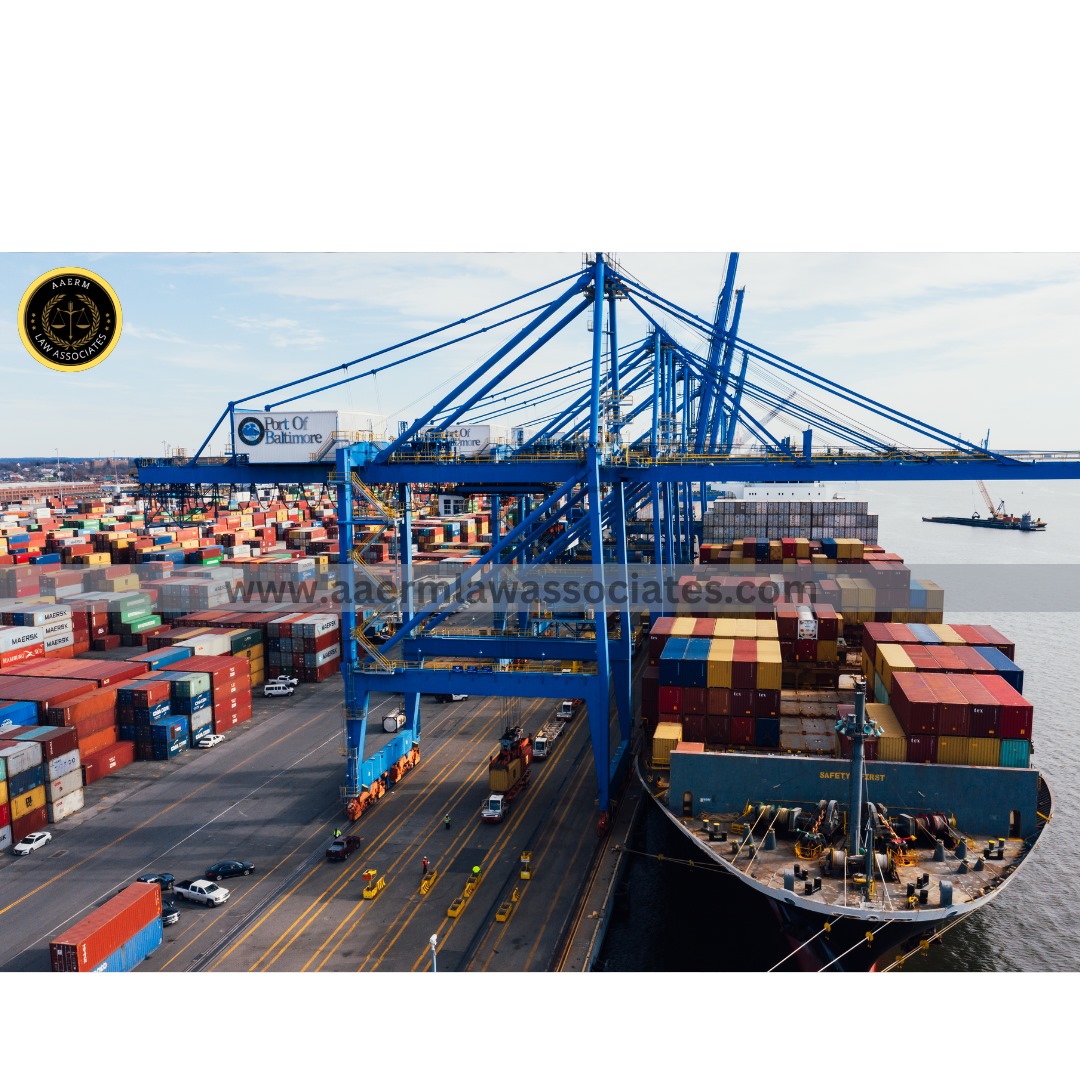

By: AdminJune 27, 2024Categories: export import|News4 Min Read The Indian government is considering extending a crucial export credit support scheme to boost the competitiveness of the country's export sector, which…

By: AdminJune 15, 2024Categories: Press Release4 Min Read India’s total exports (Merchandise and Services combined) for May 2024* is estimated at USD 68.29 Billion, registering a positive growth of 10.25…

By: AdminJune 15, 2024Categories: CBIC|Notification And Circular4 Min Read The CBIC vide Notification No. 42/2024-Customs (N.T.) dated June 12, 2024 has amended Notification No. 62/1994-Customs (N.T.) dated November 21, 1994.…

By: AdminJune 14, 2024Categories: Advance Ruling-New4 Min Read The Tamil Nadu AAR, in the matter of M/s. Sunwoda Electronic India Private Limited [Advance Ruling No. 06/ARA/2024 dated April 30, 2024],…

By: AdminMay 28, 2024Categories: Important News|Income Tax|News4 Min Read The CBDT has released a Handbook on the Annual Information Statement (AIS) and provided a list of 57 types of income…