The Hon’ble Bombay High Court, in its judgment in the case of Lalit Kulthia & Anr. v. Commissioner of Customs (Appeals) Mumbai III & Ors. [Writ Petitioner No. 476 of…

The Hon’ble Bombay High Court, in its judgment in the case of Lalit Kulthia & Anr. v. Commissioner of Customs (Appeals) Mumbai III & Ors. [Writ Petitioner No. 476 of…

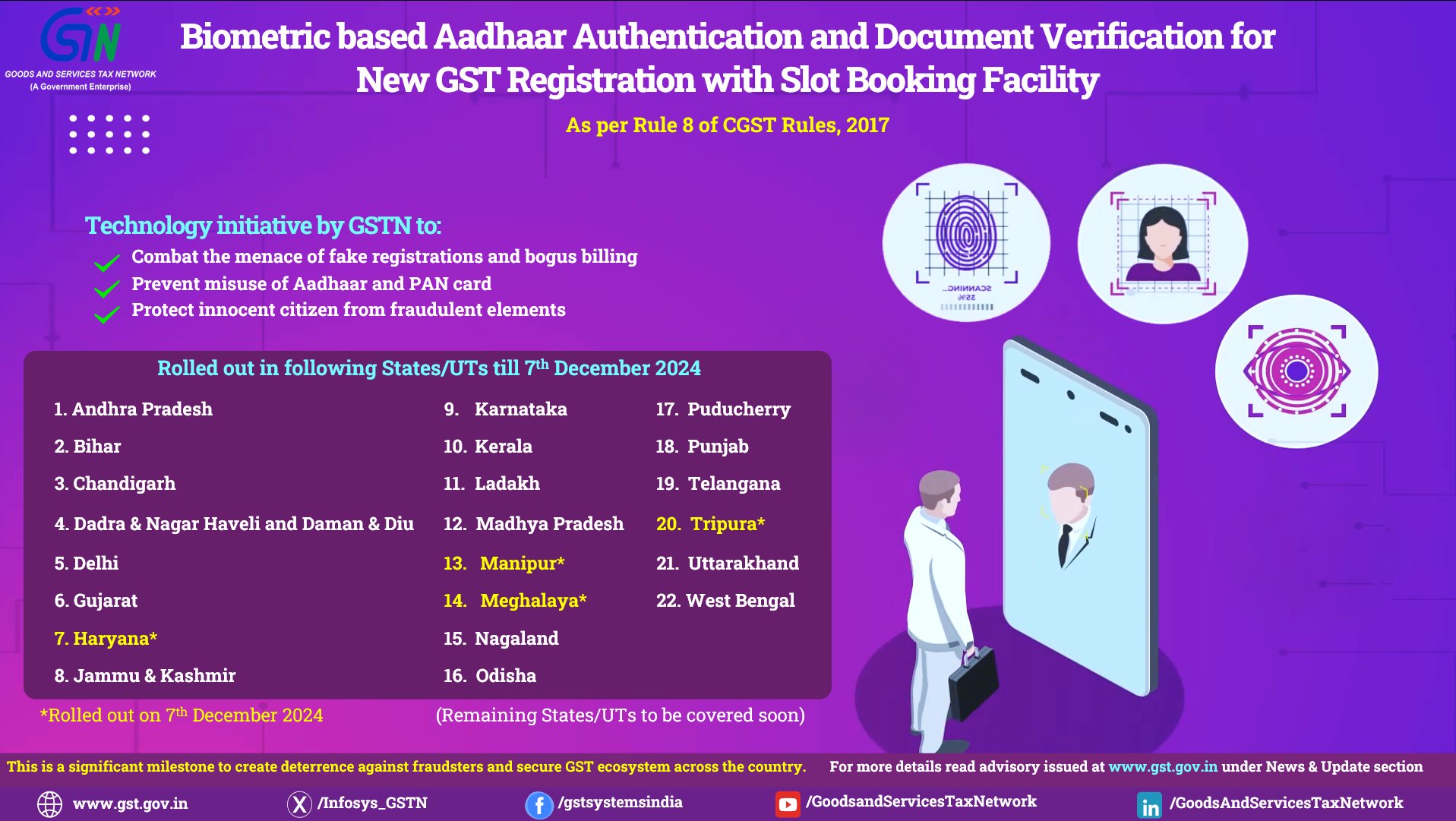

Haryana, Manipur, Meghalaya, and Tripura Added to the List The GST Network (GSTN) has expanded the biometric Aadhaar authentication and document verification facility for new GST registrations to Haryana, Manipur,…

The proposed Goods and Services Tax (GST) rate rationalisation by the Group of Ministers (GoM) has sparked mixed reactions from states, highlighting concerns over economic timing and potential impacts. Key…

Payment gateway operators have urged the finance ministry to waive the 18% GST on commissions earned from processing digital transactions under ₹2,000. The proposal will be considered during the upcoming…

A delegation of farmers met with Union Finance Minister Nirmala Sitharaman during a pre-budget consultation last week to voice their demands, including the removal of GST on agricultural inputs such…

The Central Board of Indirect Taxes and Customs (CBIC), through Notification No. 30/2024–Central Tax, dated December 10, 2024, has extended the deadline for filing GSTR-3B returns for October 2024 for…

Punjab is advocating for the extension of the GST compensation cess beyond March 31, 2026. The state argues that extending the cess is essential to address the significant revenue shortfalls…

Rajasthan will become the first state in India to introduce faceless/randomised tax administration. This initiative aims to improve transparency and efficiency in GST compliance across the state. Key Highlights of…

The Insurance Regulatory and Development Authority of India (IRDAI) and the Department of Financial Services (DFS) have voiced their support for a proposal to reduce Goods and Services Tax (GST)…

The GST Network (GSTN) issued Advisory No. 557 on December 9, 2024, addressing concerns related to mismatches between Table 8A (auto-populated data from GSTR-2B) and Table 8C (manually filled data)…