Real Money Gaming Sector Tops GST Evasion List

By: Admin

September 16, 2024

Categories: GST Recent News

4 Min Read

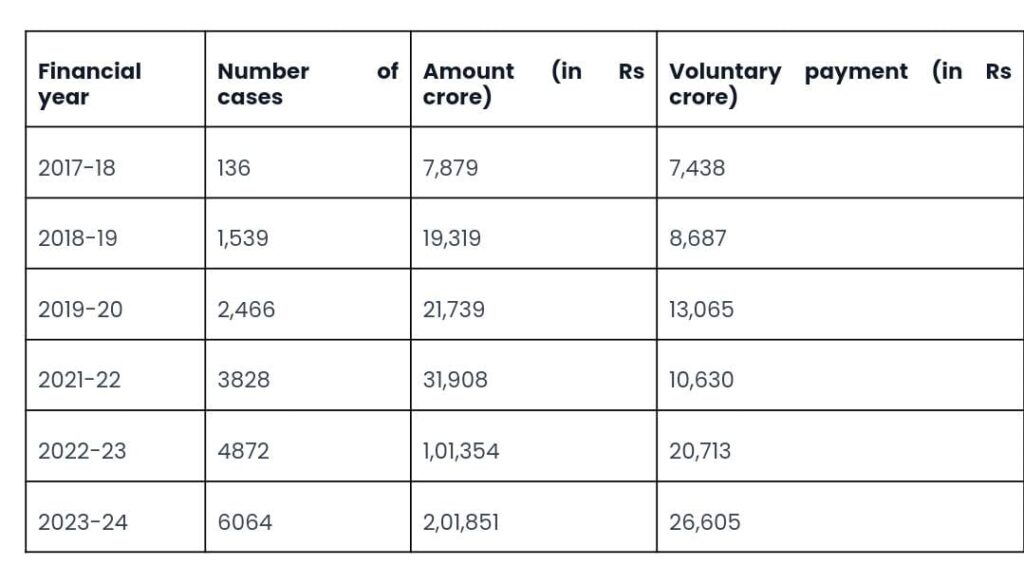

The real money online gaming sector has topped the GST evasion list, with evasion amounting to *Rs 1.10 lakh crore, according to the **Directorate General of GST Intelligence (DGGI). The investigation has led to *show cause notices to 34 taxpayers and action against 118 domestic entities and 658 offshore entities.

Key Challenges in Online Gaming:

The DGGI report highlights the difficulty in bringing offshore gaming entities under the tax net, particularly those based in tax havens like Malta, the British Virgin Islands, and Cyprus. These entities often use the dark web and VPN-based platforms to evade taxes. The DGGI has recommended blocking 167 URLs and websites related to these platforms.

Multi-Agency Approach:

To combat tax evasion, the DGGI has called for a *multi-agency approach, involving various governmental bodies such as the **CBIC, **CBDT, **Enforcement Directorate, and ministries like **Meity, **corporate affairs, and **consumer affairs. The goal is to develop a comprehensive strategy to ensure **regulatory compliance, **consumer protection, and *national security.

Evasion-Prone Sectors in FY24:

- Real money gaming: Rs 81,875 crore

- Banking, Financial, and Insurance: Rs 18,971 crore

- Work Contracts: Rs 2,846 crore

Classification of GST Evasion Cases:

- Fake ITC: 20%

- Non-Payment of Tax: 46%

- Non-Payment under RCM: 5%

- Wrong availment/non-reversal of ITC: 19%

- Others: 10%

GSTEvasion #RealMoneyGaming #OnlineGaming #DGGI #TaxHavens #FakeITC #GSTCompliance #TaxNews #MultiAgency