Invoice Management System (IMS): Transforming GST Compliance

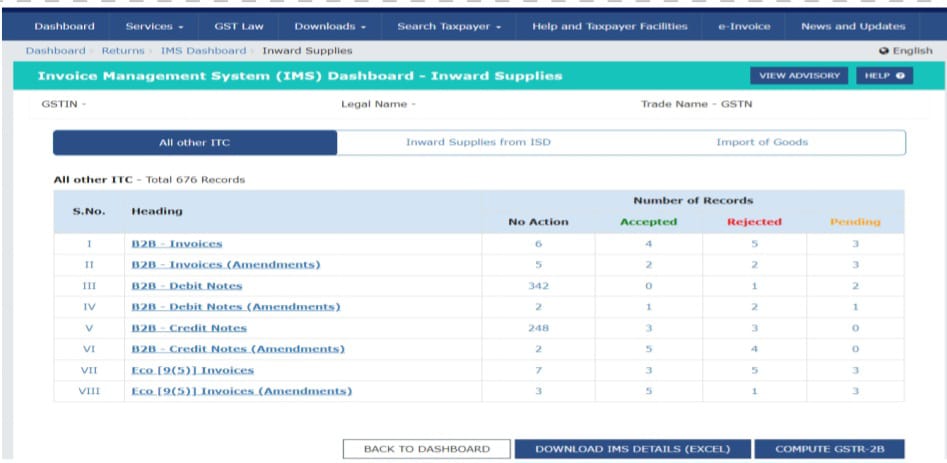

The Goods and Services Tax Network (GSTN) launched the Invoice Management System (IMS) to simplify invoice reconciliation and improve transparency in Input Tax Credit (ITC) claims. Effective from October 1st, this system enables taxpayers to manage invoices efficiently by accepting, rejecting, or deferring them through the GST portal. IMS strengthens communication between suppliers and recipients while enhancing record-matching accuracy.

What is IMS?

IMS equips taxpayers with tools to control invoice management effectively. It enables recipients to:

- Accept invoices, including them in GSTR-2B for ITC claims.

- Reject invoices, excluding them from GSTR-2B.

- Keep Pending invoices for later review.

This feature allows taxpayers to verify invoices before they appear in their returns, ensuring ITC accuracy.

Key Features of IMS

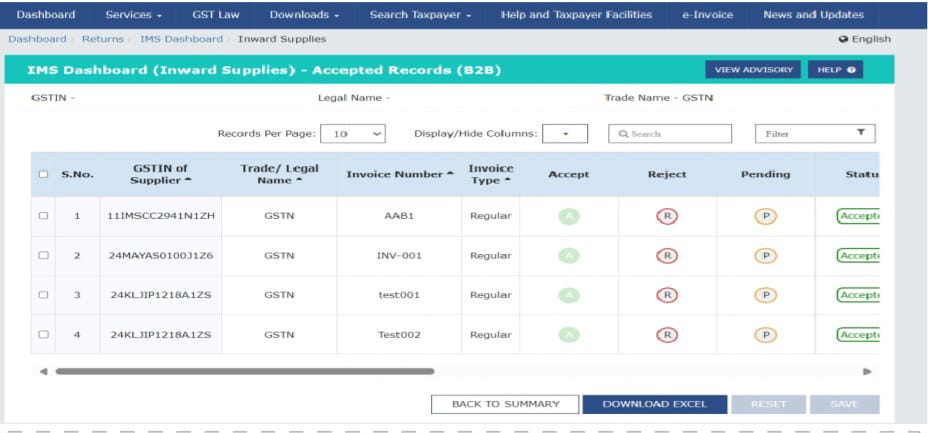

1. Invoice Actions

Taxpayers can perform three key actions on invoices:

- Accept: Accepted invoices become eligible ITC entries in GSTR-2B and automatically populate GSTR-3B.

- Reject: Rejected invoices remain outside GSTR-2B.

- Pending: Deferred invoices stay in IMS until the recipient acts on them.

2. Real-Time Integration

IMS synchronizes invoices saved in GSTR-1/IFF/1A with the recipient’s dashboard, ensuring immediate updates.

3. Automatic Invoice Acceptance

When recipients take no action before GSTR-2B generation, the system automatically accepts the invoices to maintain compliance.

4. Handling Amendments

The system updates recipient dashboards when suppliers amend invoices, allowing timely action.

5. ITC Claim Limits

Taxpayers can claim ITC on pending invoices within the limits specified under Section 16(4) of the CGST Act, 2017.

How IMS Works

- Supplier Uploads: Suppliers upload invoices to GSTR-1/IFF/1A.

- Recipient Actions:

- Accept: ITC is added to GSTR-2B.

- Reject: ITC is excluded.

- Pending: ITC is deferred.

- GSTR-2B Generation: The system creates draft GSTR-2B on the 14th of the subsequent month, reflecting recipient actions.

- Recomputation: The system updates GSTR-2B if recipients act after the 14th or if suppliers amend invoices.

Provisions for QRMP Taxpayers

IMS supports taxpayers under the Quarterly Return Monthly Payment (QRMP) scheme.

- GSTR-2B generation follows the quarterly schedule for QRMP taxpayers.

- The system does not generate GSTR-2B for the first two months of each quarter.

Benefits of IMS

- Improved Transparency: Taxpayers can authenticate invoices before claiming ITC.

- Enhanced ITC Accuracy: Only verified invoices appear in GSTR-2B.

- Simplified Compliance: IMS streamlines communication between suppliers and recipients.

- Error Minimization: The system ensures proper handling of amendments.

Important Considerations

- Mandatory Recalculation: Taxpayers must recompute GSTR-2B when actions occur after the 14th of the month.

- Sequential Filing Requirement: The system generates GSTR-2B for a return period only after taxpayers file GSTR-3B for the previous period.

- Direct Population of Certain Supplies: Reverse charge mechanism supplies bypass IMS and go directly into GSTR-3B.

Conclusion

IMS represents a significant leap in GST compliance and transparency. By facilitating real-time communication and accurate ITC matching, the system minimizes discrepancies and simplifies compliance for taxpayers. Businesses should familiarize themselves with IMS to optimize its advantages and streamline their GST filing processes.