GSTN Releases Offline Tools for GSTR-9 and GSTR-9C for FY 2023-24, Filing to Begin Soon

By: Admin

October 15, 2024

Categories: GST Portal Updates | Important News

4 Min Read

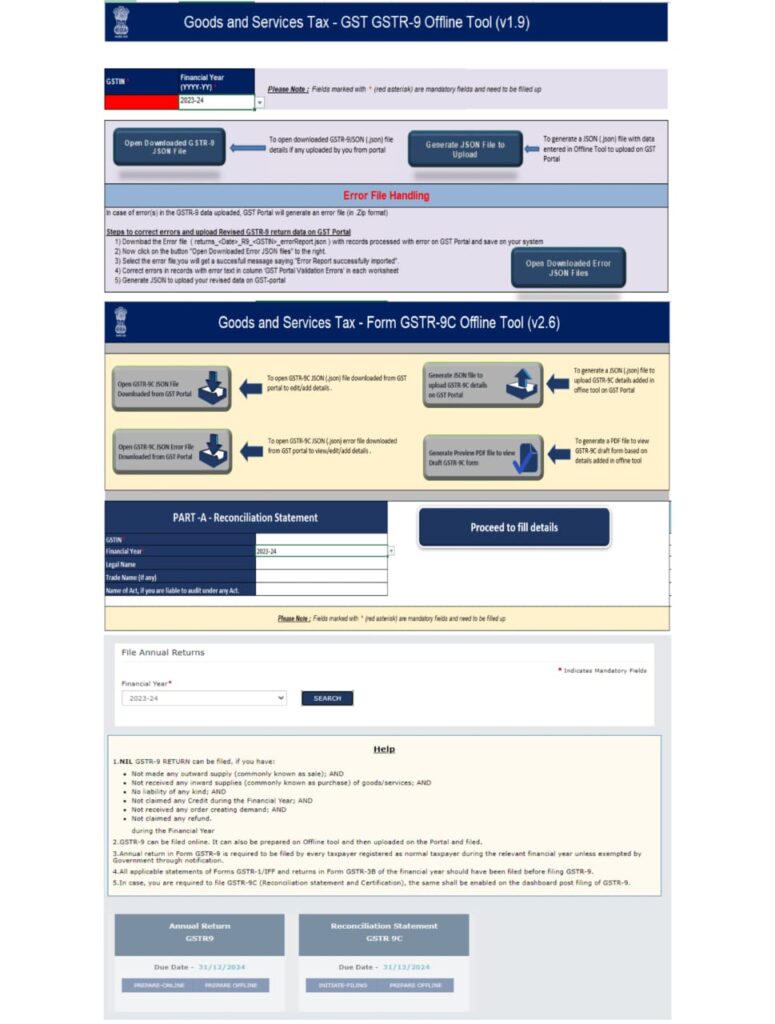

The Goods and Services Tax Network (GSTN) has announced the release of offline tools for GSTR-9 (v1.9) and GSTR-9C (v2.6) for FY 2023-24 on October 15, 2024. While these tools are now available for download, the filing process is expected to begin by the end of the day.

GSTR-9 Offline Tool (v1.9)

The GSTR-9 offline tool helps taxpayers prepare their annual returns offline, which can then be uploaded to the GST portal. This Excel-based utility requires:

Windows 7 or above

Microsoft Excel 2007 or later

The tool can be downloaded from the GST portal. Taxpayers are advised to verify that the downloaded file is not corrupted before extracting and using it.

GSTR-9C Offline Utility (v2.6)

The GSTR-9C offline utility assists in preparing auditor-certified reconciliation statements for financial years prior to FY 2020-21, and self-certified statements thereafter. It requires:

Windows 7 or above

Microsoft Excel 2010 or later

Similar to GSTR-9, the downloaded file should be checked for any corruption before extraction.

These tools aim to facilitate a smooth filing process for taxpayers, ensuring that they can prepare their returns and reconciliation statements efficiently.

GSTR9 #GSTR9C #GSTFiling #GSTPortalUpdates #TaxpayerTools