GSTN Issued Important Advisory on Issuance of Notices/Orders Without Digital Signatures of the Issuing Authorities

By: Admin | September 26, 2024 | Categories: GST Law | GST Portal Updates | Important News | 4 Min Read

On September 26, 2024, the Goods and Services Tax Network (GSTN) issued Advisory No. 524, clarifying the validity of documents such as show cause notices (SCNs), assessment orders, and refund orders issued through the GST common portal without visible digital signatures.

Key Clarifications:

- No Physical Digital Signature Required: Documents generated on the GST portal, including SCNs and orders, do not need physical digital signatures since they are issued by tax officers logged in through their digital signatures. These documents are digitally authenticated and stored in the GST system with the issuing officer’s digital signature.

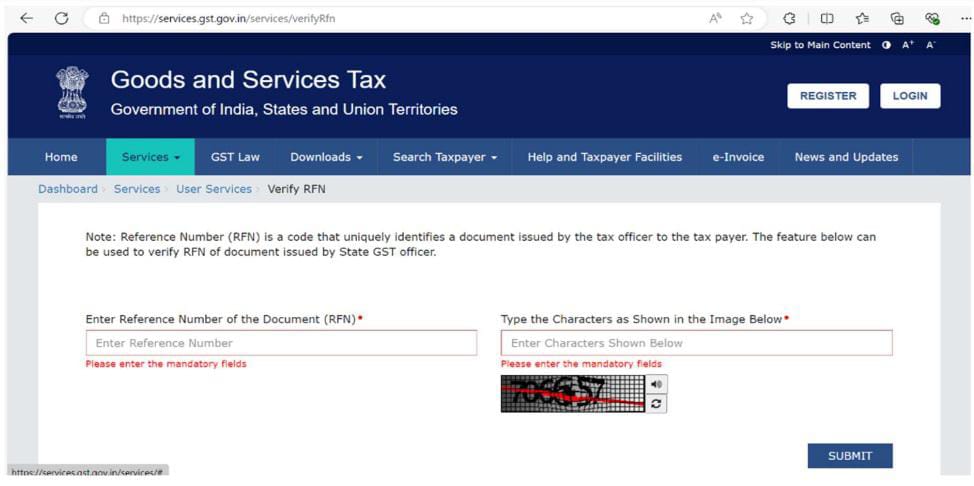

- Verifying Document Validity: Taxpayers can verify the authenticity of such documents through the GST portal:

- Post-login verification:

- Navigate to:

www.gst.gov.in → Dashboard → Services → User Services → Verify RFN

- Navigate to:

- Pre-login verification:

- Use the link: Verify RFN

- Actions Requiring Digital Signature Authentication:

- Issuance of any notice

- Issuance of any order

- Issuance of any refund order

This advisory eliminates concerns about the validity of unsigned documents on the portal, emphasizing that all critical actions by officers are digitally signed within the system.

GSTAdvisory #DigitalSignatures #GSTPortal #TaxNotices #RefundOrders #GST