GST Portal Update: Negative Values Now Allowed in GSTR-3B to Address Negative Liability

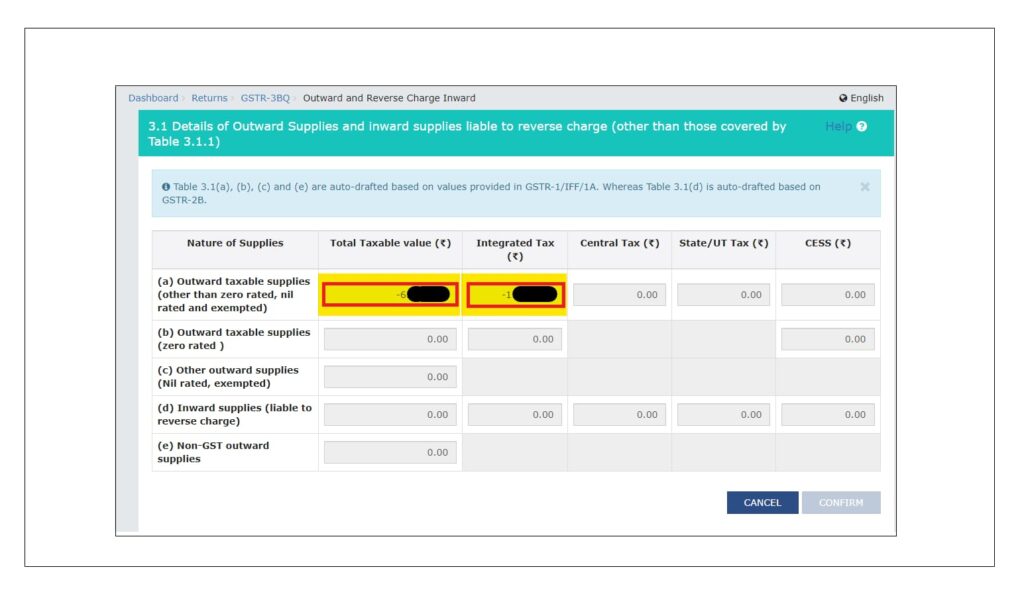

The GST Network (GSTN) has introduced a significant update on the GST portal, allowing taxpayers to report negative values in the Outward Supply Table 3.1 of GSTR-3B. This update addresses longstanding issues related to negative liability, especially in scenarios where taxpayers have sales return transactions but no outward sales in a specific month.

Why the Update Was Needed

Taxpayers frequently faced challenges when they had negative liability, particularly in cases involving:

- Sales Returns Without Sales: When the total outward supply for a given period is zero or negative due to returns.

- Inability to Report Negative Values: Previously, the GST portal did not allow reporting of negative values, leading to mismatches and difficulties in reconciling liabilities.

This update resolves these issues, ensuring accurate reporting and reducing compliance burdens.

Key Features of the Update

Negative Values in Table 3.1: Taxpayers can now enter negative figures in the Outward Supply Table 3.1 of GSTR-3B.

Automated Adjustments: Negative liability will automatically adjust against future periods, ensuring seamless reconciliation.

Simplified Compliance: This change eliminates manual corrections and avoids unnecessary delays in resolving negative liability disputes.

Who Benefits from This Update?

Businesses with High Returns: Entities in industries like retail and e-commerce, where returns are common, will benefit the most.

Seasonal Businesses: Businesses with fluctuating sales cycles can now reconcile their returns more effectively.

Implications for Taxpayers

Enhanced Reporting Accuracy: Taxpayers can now accurately report net sales after accounting for returns.

Reduced Errors: The update minimizes the risk of liability mismatches and penalties due to incorrect reporting.

Better Cash Flow Management: Automated adjustments to negative liability improve cash flow predictability.

Conclusion

The GSTN’s decision to allow negative values in GSTR-3B is a significant step forward in simplifying GST compliance and addressing taxpayers’ concerns. Taxpayers are advised to update their compliance systems and processes to incorporate this new functionality for smoother filing experiences.

Stay tuned for more GST updates and compliance tips!