Government Extends Deadline for Linking PAN and Aadhaar to 30th June, 2023: A Relief for Taxpayers

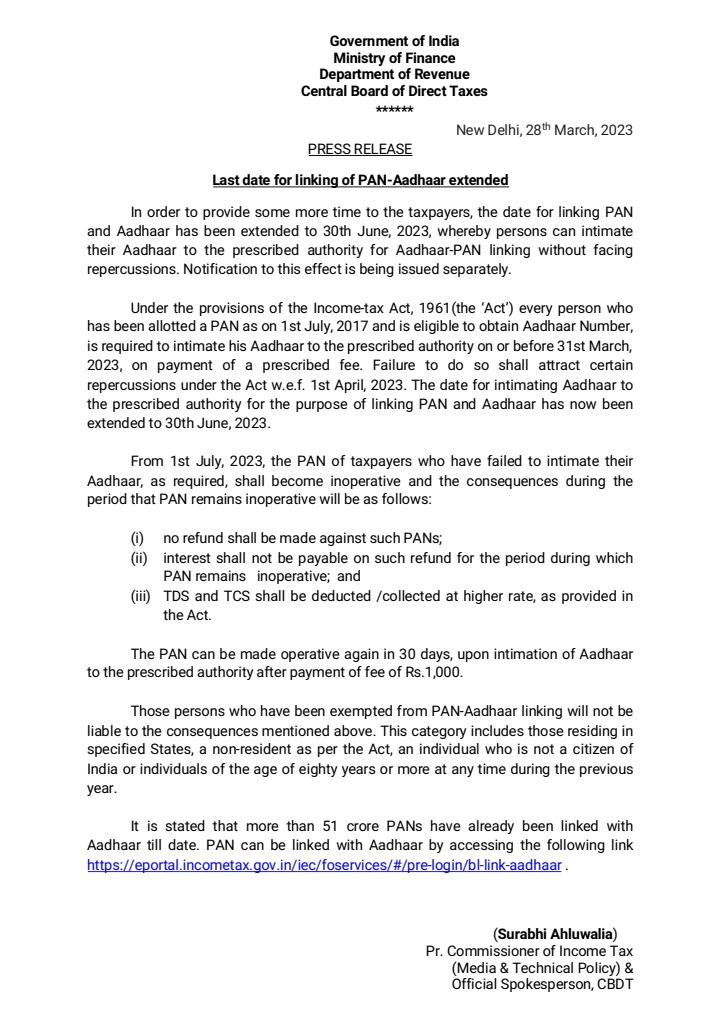

n a recent move, the Indian government has extended the deadline for linking Permanent Account Number (PAN) with Aadhaar to 30th June, 2023. This decision has been taken to provide taxpayers with more time to comply with the mandate. From 1st July, 2023, unlinked PAN cards will become inoperative, which means that individuals who fail to link their Aadhaar with PAN before the deadline will face consequences.

PAN is a ten-digit unique identification number issued to every taxpayer in India. It is used for various financial transactions such as filing income tax returns, opening bank accounts, and investing in securities. Aadhaar, on the other hand, is a twelve-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). It contains an individual’s biometric and demographic information and is used for various government schemes and services.

The government has been making efforts to link PAN with Aadhaar for the past few years to curb tax evasion and improve compliance. The linking of PAN with Aadhaar helps to establish the identity of the taxpayer and eliminates the possibility of multiple PAN cards issued to a single person. It also helps in tracking financial transactions and identifying individuals who do not file tax returns.

However, many individuals have faced difficulties in linking their PAN with Aadhaar due to technical glitches and other issues. To provide relief to such individuals, the government has extended the deadline for linking PAN with Aadhaar multiple times in the past. The latest extension until 30th June, 2023, gives taxpayers ample time to comply with the mandate.

From 1st July, 2023, unlinked PAN cards will become inoperative. This means that individuals who have not linked their Aadhaar with PAN by the deadline will not be able to use their PAN for various financial transactions. In such cases, the PAN can be made operative again within 30 days of intimation of Aadhaar to the prescribed authority after payment of a fee of Rs. 1,000.

It is important for taxpayers to link their PAN with Aadhaar before the deadline to avoid any inconvenience. Non-compliance can result in penalties and other consequences. The extension of the deadline is a welcome move as it provides more time for taxpayers to comply with the mandate.

the government’s decision to extend the deadline for linking PAN with Aadhaar to 30th June, 2023, is a relief for taxpayers who have been facing difficulties in complying with the mandate. It is important for individuals to link their PAN with Aadhaar before the deadline to avoid any inconvenience. The linking of PAN with Aadhaar will help in curbing tax evasion and improving compliance, which is beneficial for the economy as a whole.