CBIC Updates Penal Provisions in FORM INS-01

By: Admin

October 10, 2024

Categories: 54th GST Council

4 Min Read

Background:

The Ministry of Home Affairs, through Notification S.O. 850(E), has replaced the Indian Penal Code (IPC) with the Bharatiya Nyaya Sanhita, 2023 (45 of 2023), effective from July 01, 2024. Consequently, new legal provisions apply to various laws, including GST-related forms.

Key Update:

The Central Board of Indirect Taxes and Customs (CBIC), via Notification No. 20/2024 – Central Tax dated October 08, 2024, has updated the penal provisions in FORM GST INS-01. The sections of the Indian Penal Code have been substituted with corresponding sections of the Bharatiya Nyaya Sanhita, 2023.

Changes:

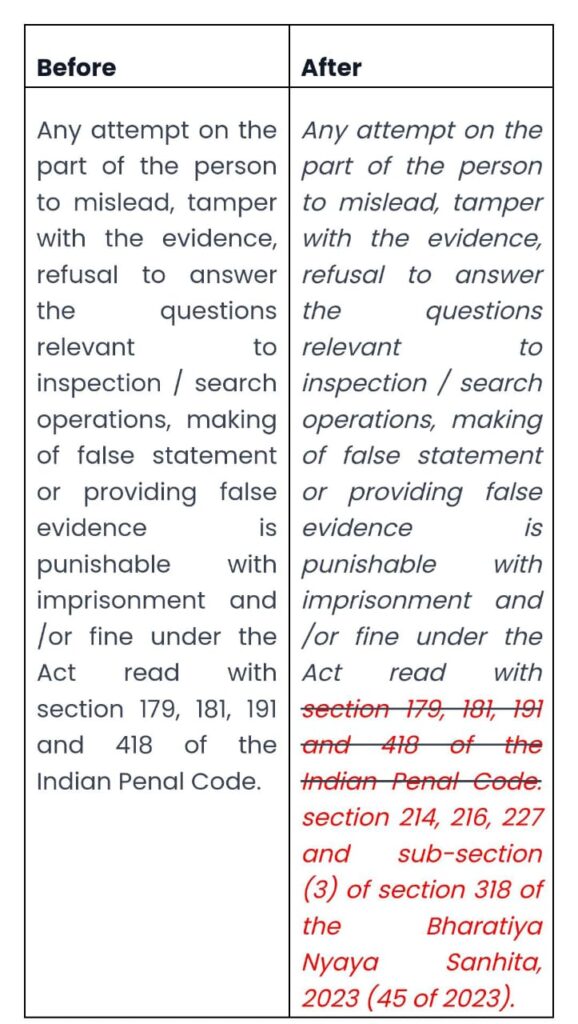

Before: Penal provisions were governed by sections 179, 181, 191, and 418 of the Indian Penal Code.

After: These sections have been replaced with sections 214, 216, 227, and sub-section (3) of section 318 of the Bharatiya Nyaya Sanhita, 2023.

This update applies to instances of misleading conduct, tampering with evidence, refusal to answer questions, or providing false information during inspection/search operations.

Our Comments:

The notification updates legal references in FORM GST INS-01 to reflect the transition from the IPC to the Bharatiya Nyaya Sanhita, 2023, ensuring that GST forms are aligned with the new legal framework. The offenses and penalties remain unchanged, but the references are now consistent with the new legal code. This ensures compliance with the updated provisions and promotes legal accuracy under the Bharatiya Nyaya Sanhita.

CBIC #GSTUpdate #PenalProvisions #BharatiyaNyayaSanhita #GSTLaw #LegalUpdate