CBIC Notifies Adjustment of Negative Liability in FORM GSTR-3B

By: Admin July 11, 2024 Categories: 53rd GST Council Meet | Notification & Circular

Background

Previously, CBIC via Notification No. 14/2022 – Central Tax dated July 05, 2022, allowed negative amounts in Table 4(A) or Table 4D(2) of FORM GSTR-3B from January 2023 onwards. This was permitted when the value of credit notes exceeded the sum of invoices and debit notes, resulting in negative net ITC. However, adjustments for negative liability in Table 3 of FORM GSTR-3B were not allowed.

To clarify the correct reporting of ITC availed, reversed, and ineligible ITC, a Press Release/GST News and Updates was issued on February 17, 2023.

Notification

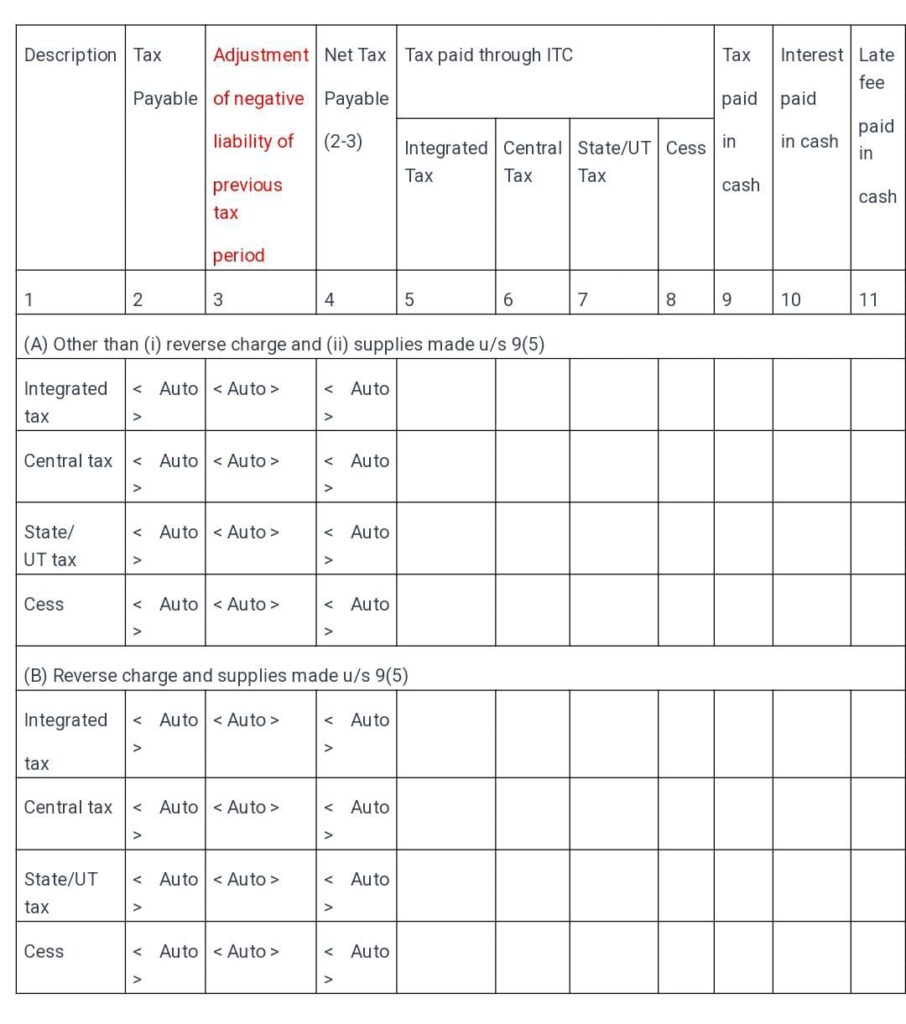

Now, the CBIC, via Notification No. 12/2024 – Central Tax dated July 10, 2024, under Section 164 of the CGST Act, has amended Table 6.1 of FORM GSTR-3B by introducing a new table, “Adjustment of negative liability of previous tax period,” effective from a date yet to be notified.

Effect of the Notification

This new provision will allow taxpayers to directly adjust negative liability in FORM GSTR-3B. When this facility is implemented on the GST Portal, negative liability will be automatically adjusted. The negative liability amount will be sourced from FORM GSTR-1 and reflected under Table 6.1 – “Adjustment of negative liability of previous tax period” in FORM GSTR-3B. This automation eliminates the need for taxpayers to manually perform these adjustments.

CBIC #GSTR3B #NegativeLiability #TaxCompliance #53rdGSTCouncilMeet #Notification