By: AdminJanuary 11, 2025Categories: CBI | News4 Min Read The Central Bureau of Investigation (CBI) has filed a case against an income tax inspector and an employee of a private…

By: AdminJanuary 11, 2025Categories: CBI | News4 Min Read The Central Bureau of Investigation (CBI) has filed a case against an income tax inspector and an employee of a private…

By: AdminJanuary 11, 2025Categories: TAX News4 Min Read The decision to abolish the angel tax has encouraged many Indian start-ups to return home by relocating their headquarters to India, according…

By: AdminJanuary 11, 2025Categories: Income Tax News | News4 Min Read The Indian tax system operates on a trust-based model, with over 99% of tax returns accepted without scrutiny, according…

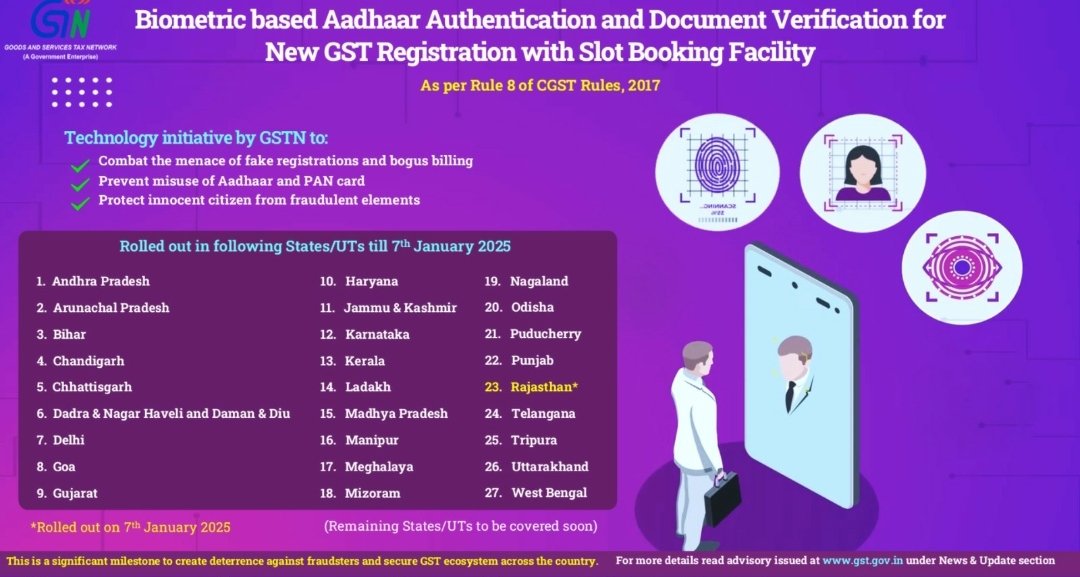

The biometric-based Aadhaar authentication and document verification system for new GST registrations, coupled with a slot booking facility, has been extended to Rajasthan. As of January 7, 2025, this initiative…

Published by: Admin | January 09, 2025 | Categories: GST Recent News | 4 Min Read Taxpayers in Kerala burdened with multiple GST show cause notices across districts can now…

By: AdminDate: January 6, 2025Categories: Important News | Income Tax NewsReading Time: 4 Min The Income Tax Department has launched an updated version of the Excel-based utility for filing ITR-2…

By: Admin | Date: December 28, 2024Categories: Tax News | Read Time: 4 Min The Indian government plans to amend the Income Tax Act in Budget 2025, introducing a presumptive…

By: Admin | Date: December 28, 2024Categories: Important News | Income Tax News | Read Time: 4 Min The Income Tax Department has unveiled a new feature on its portal,…

By: Admin | Date: December 28, 2024Categories: Important Pronouncements | Read Time: 4 Min The Hon’ble Allahabad High Court, in Chandani Tent Traders v. State of U.P. [WRIT TAX NO.…

By: Admin | December 27, 2024Categories: GST Recent News | 4 Min Read Overview of the Issue The Goods and Services Tax (GST) authorities have issued show cause-cum-demand notices to…