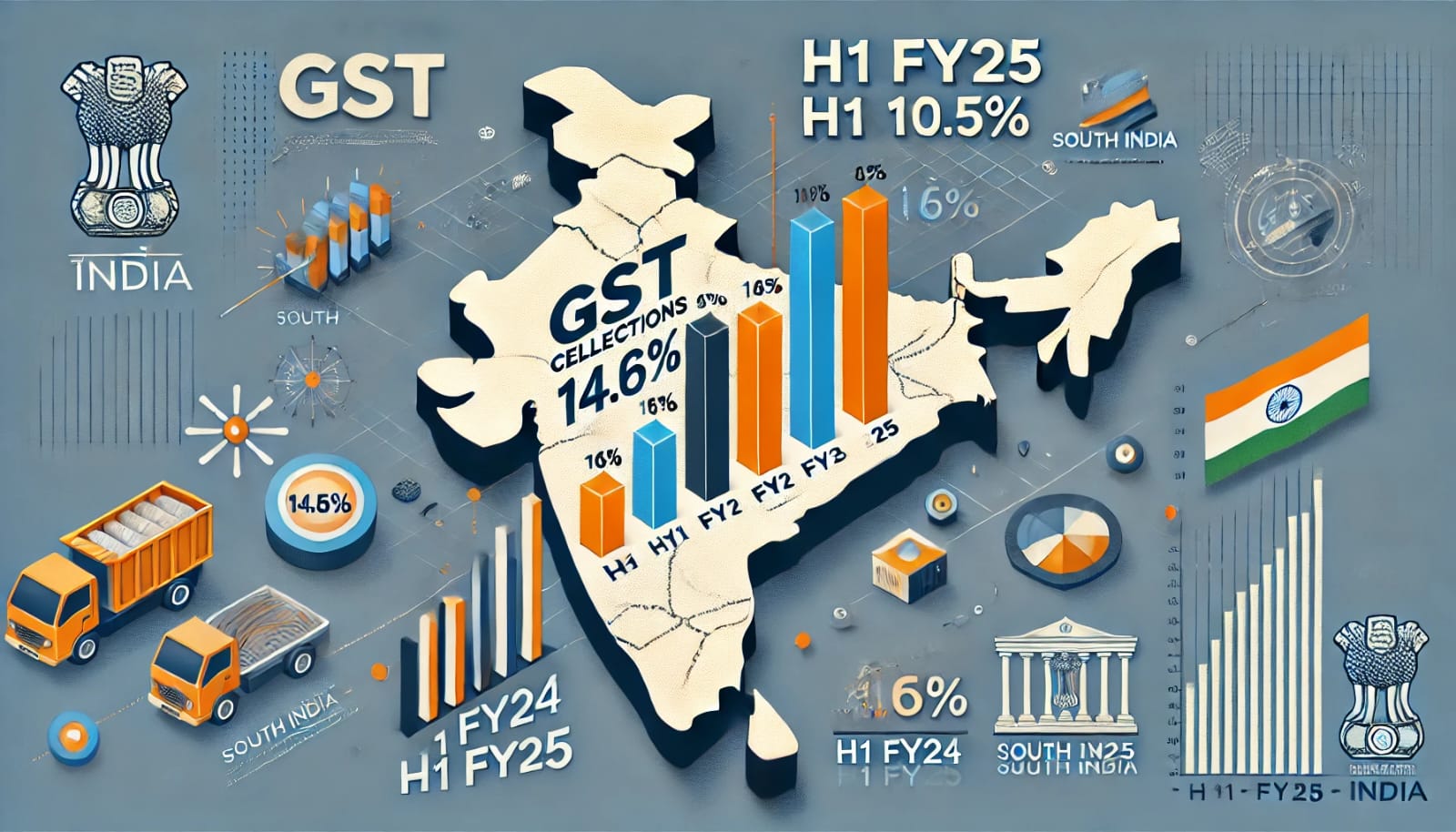

GST Collections Decline in H1 FY25: A Cause for Concern

India’s Goods and Services Tax (GST) collections have slowed in the first half of the fiscal year 2024-25 (H1 FY25), highlighting weakening consumption trends. Domestic GST revenues grew by 10.5% year-on-year to ₹9.65 lakh crore between April and October 2024. However, this growth is noticeably slower compared to the 14.6% increase during the same period last year.

Regional Insights: South India Faces Challenges

Several southern states have reported particularly weak GST collection growth, driven by declining discretionary spending and supply chain disruptions in critical sectors. These issues have intensified concerns about state revenues and their ability to meet fiscal year-end targets.

Key Factors

- Reduced consumer spending.

- Ongoing supply chain bottlenecks.

- Industry-specific slowdowns, especially in manufacturing and retail.

Broader Implications for the Economy

GST collections serve as a key measure of economic activity, capturing consumption trends and business performance. The current deceleration suggests that economic growth is losing momentum. Sectors such as:

- Manufacturing: Facing cost pressures and lower demand.

- Retail: Experiencing subdued consumer sentiment.

- Real Estate: Slowing due to rising input costs and cautious investments.

As a result, policymakers and business leaders must address these challenges to sustain economic momentum.

The Way Forward: Expert Recommendations

To counteract the slowdown, targeted interventions are essential. Suggested measures include:

- Boosting Consumption: Introduce consumer-focused incentives to drive spending.

- Streamlining Tax Compliance: Simplify GST procedures to reduce the burden on businesses.

- Improving Infrastructure: Invest in supply chain and transport systems to ensure seamless operations.

- Enhancing Credit Access: Provide easier loans to businesses to stimulate production and growth.

These steps, if implemented effectively, can rejuvenate economic activity and support achieving GST targets for FY25.