CBDT Mandates Electronic Filing of Forms 42, 43, and 44

By: Admin

Date: November 22, 2024

Category: CBDT Notification | Notification and Circular

Reading Time: 4 Minutes

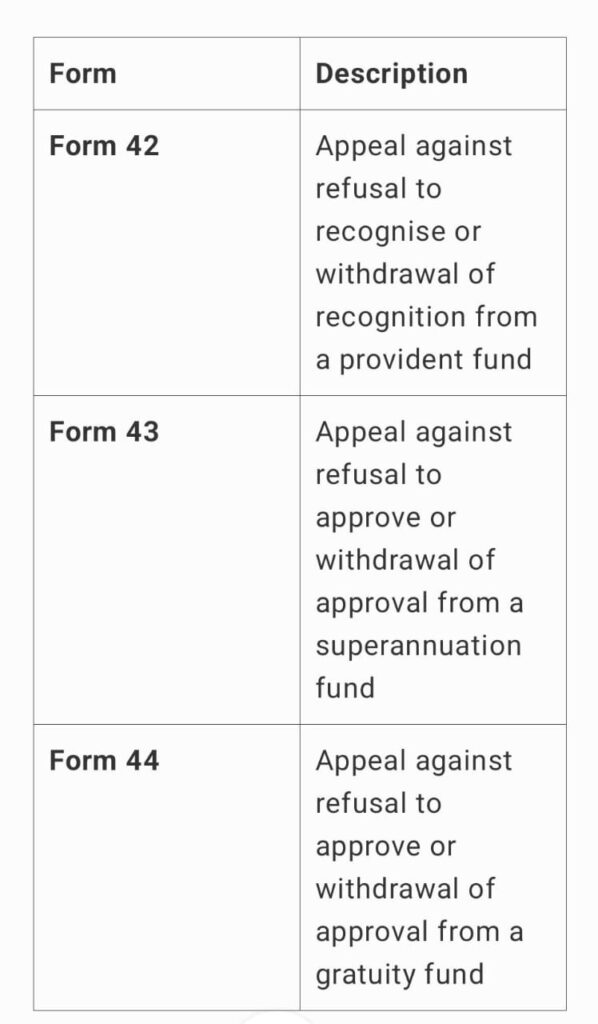

The Central Board of Direct Taxes (CBDT) now requires electronic filing for certain forms under Rule 131 of the Income Tax Rules, 1962. This mandate, announced through Notification No. 06/2024 on November 19, 2024, applies to Forms 42, 43, and 44 and takes effect from November 22, 2024.

Details of the Mandate

Electronic Filing Requirements

Taxpayers must now submit Forms 42, 43, and 44 electronically. These forms must also be verified as outlined in sub-rule (1) and sub-rule (2) of Rule 131.

Effective Date

Starting November 22, 2024, this requirement aligns with the government’s efforts to modernize tax administration and improve compliance efficiency.

Key Points to Note

1. Verification Requirements

Taxpayers must verify these forms electronically, ensuring compliance with the specified rules.

2. Simplified Process

The electronic submission process aims to reduce manual errors and make compliance more straightforward for taxpayers.

3. Updated Taxpayer Obligations

Entities filing these appeals must adhere to the revised procedure without delay. Familiarity with the new system will help taxpayers avoid potential penalties.

Implications for Taxpayers

This initiative underscores CBDT’s commitment to digitizing tax processes, which significantly enhances transparency and accountability. Furthermore, it simplifies the appeals process, helping taxpayers save time and effort.

Next Steps

Taxpayers and entities should:

- Familiarize themselves with the electronic filing portal.

- Ensure they understand verification requirements under Rule 131.

- Submit their forms electronically by the stipulated deadlines.

For further guidance, refer to Notification No. 06/2024, available on the official Directorate of Income Tax (Systems) website.