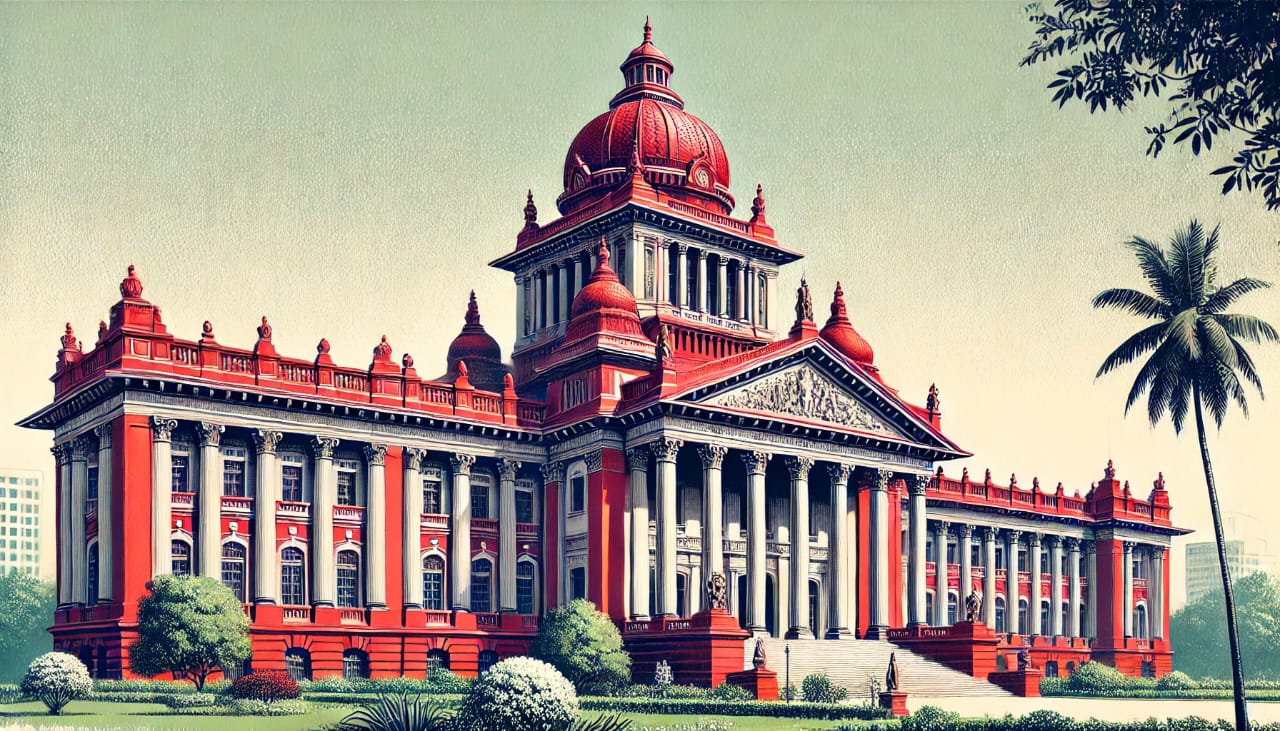

Karnataka High Court Restrains ICTPI from Offering Tax-Related Courses

Date: November 16, 2024

Category: ICAI | News

The Karnataka High Court has issued an interim order restraining the Institute of Chartered Tax Practitioners India (ICTPI), a Bengaluru-based organization, from enrolling candidates or certifying individuals to practice in areas such as income tax, GST, and customs brokerage until further notice.

Background of the Case

This significant decision was passed by Justice Suraj Govindaraj in response to a petition filed by the Institute of Chartered Accountants of India (ICAI). The ICAI accused ICTPI of several violations, including:

- Offering courses like the Post Graduate Diploma in Taxation and Professional Skill Qualification without legal recognition.

- Misleading the public by falsely claiming legitimacy and association with ICAI.

- Violating Section 15A of the Chartered Accountants Act, 1949, which prohibits unauthorized entities from offering education in areas regulated by ICAI.

Details of the Court Order

The court order specifically prohibits ICTPI from:

- Enrolling candidates in any taxation-related courses or certifications.

- Certifying individuals to practice as tax professionals or brokers.

- Registering members under categories such as affiliates, associates, fellows, honorary, or academic to offer tax-related programs.

ICAI’s Allegations Against ICTPI

Fictitious Courses

ICTPI allegedly offers courses that lack legal recognition, misleading students into believing they are legitimate qualifications.

Financial Exploitation

Many candidates have reportedly paid significant fees to enroll in ICTPI’s unauthorized programs.

Misuse of Name

ICTPI’s name closely resembles ICAI, creating confusion and a false impression of affiliation.

Lack of Government Action

Despite ICAI’s complaints, government authorities, including the Ministry of Finance, Registrar of Companies, and UGC, have yet to take action against ICTPI.

Implications of the Ruling

For ICTPI

The organization is now barred from admitting students or issuing certifications until the court lifts the interim order.

For Students

Students are advised to carefully verify the legal status of courses before enrolling to avoid falling prey to such misrepresentations.

For ICAI

The ruling reaffirms ICAI’s authority as the sole regulator of Chartered Accountancy and related fields.

This case underscores the critical need for stringent regulation of educational bodies to safeguard public interest and uphold professional standards.