GSTN: Adjustment of Negative Liability of Previous Tax Period Now Implemented in Form GSTR-3B

By: Admin

October 11, 2024

Categories: GST Portal Updates | Important News

4 Min Read

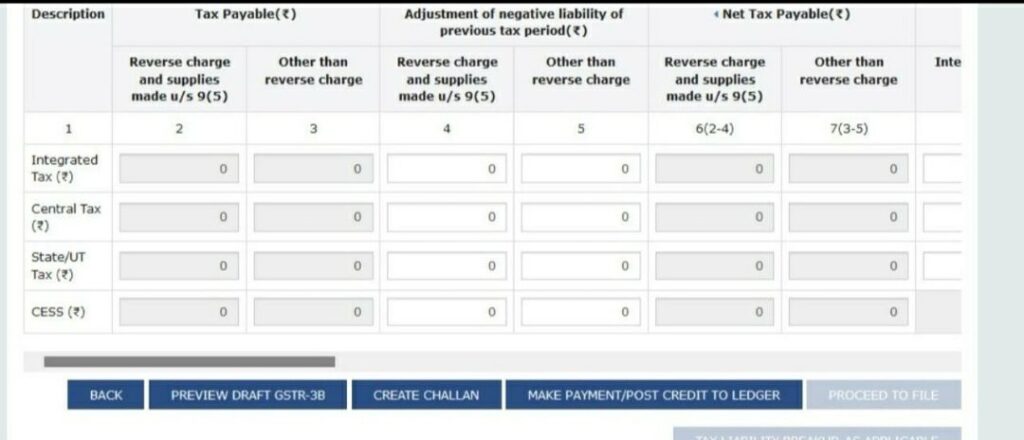

In a recent update, the Goods and Services Tax Network (GSTN) announced that the adjustment of negative liability from previous tax periods has now been implemented in Form GSTR-3B, effective from September 2024. This change follows the amendment to Rule 61(5), as notified in Notification No. 12/2024–Central Tax dated 10th July 2024.

This update is expected to simplify the filing process for taxpayers by allowing them to adjust any negative liability from past tax periods directly in their GSTR-3B forms, thereby improving accuracy and reducing compliance burdens.

GSTPortalUpdate #GSTR3B #NegativeLiability #GSTNews #CentralTax