CBIC Notifies Reverse Charge Mechanism on Metal Scrap Supply by Unregistered Persons

By: Admin

October 08, 2024

Categories: 54th GST Council

4 Min Read

The Central Board of Indirect Taxes and Customs (CBIC) has introduced a Reverse Charge Mechanism (RCM) for the supply of metal scrap by unregistered persons to registered persons, as recommended in the 54th GST Council meeting held on September 09, 2024. This new mechanism will take effect from October 10, 2024, as per Notification No. 06/2024-Central Tax (Rate) dated October 08, 2024.

Key Details:

- RCM on Metal Scrap:

When an unregistered person supplies metal scrap to a registered person, the registered recipient is liable to pay the GST under the Reverse Charge Mechanism (RCM).

Even if the supplier is below the GST threshold limit, the recipient must pay the applicable tax.

- Supplier’s Registration Requirement:

The unregistered supplier must take GST registration once their turnover crosses the threshold limit, at which point the normal tax regime would apply.

- TDS Applicability:

For B2B (Business-to-Business) transactions involving metal scrap, a 2% TDS (Tax Deducted at Source) will apply if the supplier is a registered person.

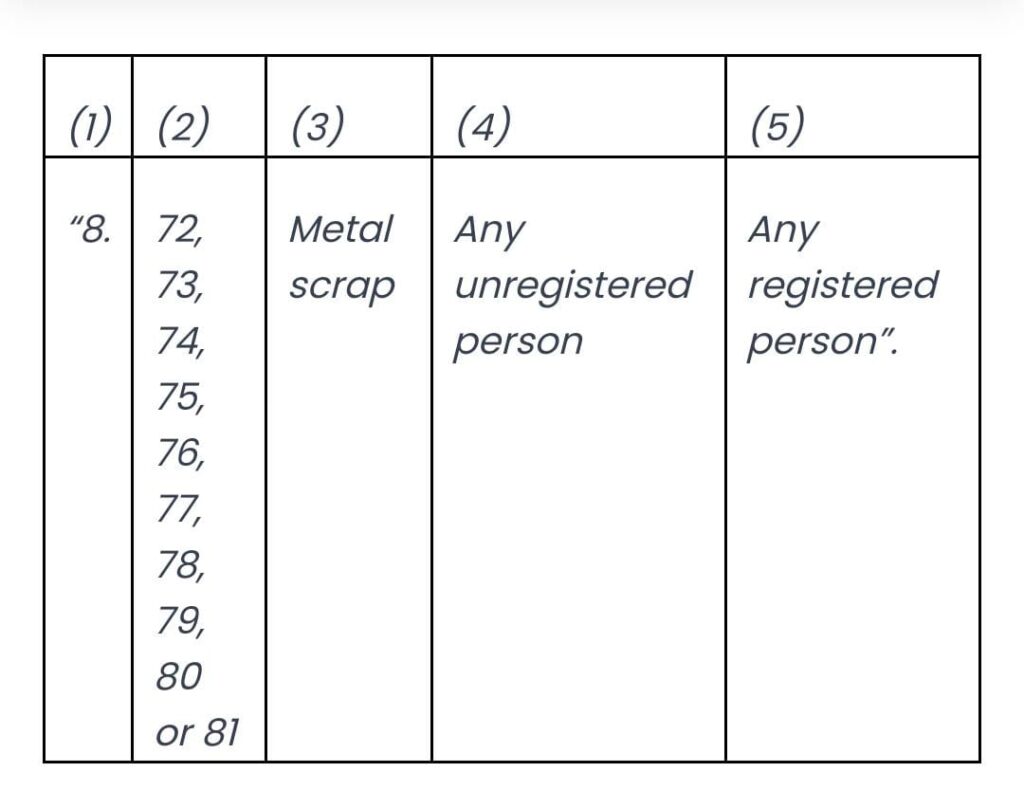

Amendment in Notification No. 4/2017:

CBIC has made amendments to Notification No. 4/2017-Central Tax (Rate) to reflect these changes. The following new entry has been added:

Applicable Across GST Acts:

Similar notifications have been issued under the Integrated Goods and Services Tax Act, 2017 (IGST Act) and the Union Territory Goods and Services Tax Act, 2017 (UTGST Act), ensuring uniformity in the implementation of the Reverse Charge Mechanism for metal scrap.

This change is expected to streamline tax compliance and ensure greater accountability in the metal scrap supply chain.